Total proved reserves: 21 MM BOE

Proved reserves by commodity: 67% gas…30% oil…4% NGL

States: Texas, Louisiana, Colorado

Net leasehold acres: 90,000

Well count: 312

BOEPD: 4,000 (60% gas)

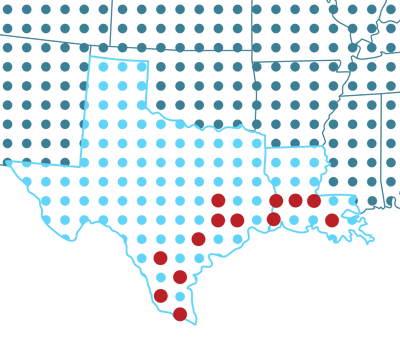

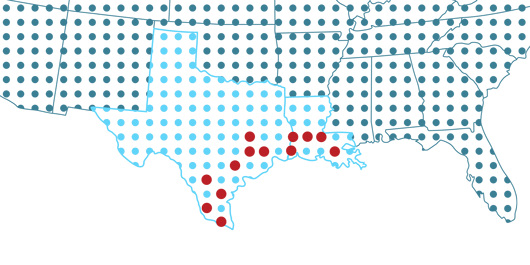

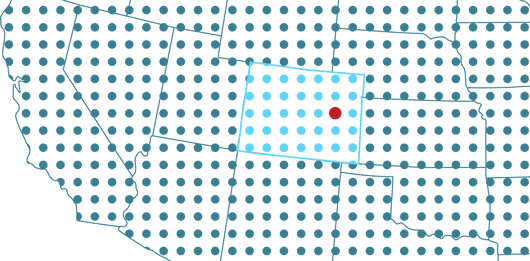

Gulf Coast

16 counties (TX), 16 parishes (LA)

Producing wells: 268

Net acres: 60,000

Proved reserves: 18.8 MM BOE

Mostly vertical, conventional, long-life, low-decline gas-weighted assets and associated production facilities in southern Texas and Louisiana. Assets across the Austin Chalk, Wilcox and Tuscaloosa trends with significant low-risk development inventory.

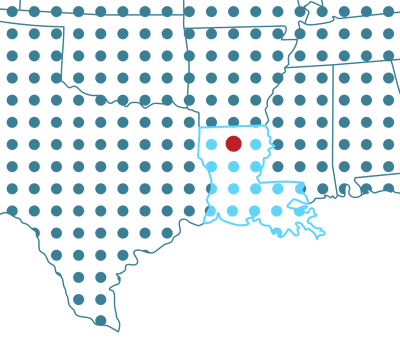

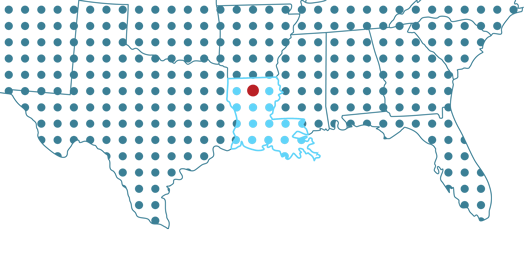

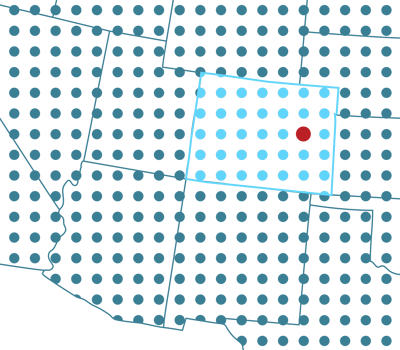

Ark-La-Tex

Caddo, Claiborne, Webster Parishes LA

Producing wells: 29

Net acres: 14,000

Proved reserves: 1.7 MM BOE

Low-geologic-risk assets in northern Louisiana with shallow annual declines. Includes rights to Haynesville, Cotton Valley, and Smackover formations with upside in incremental drilling and development. Midstream infrastructure with 2-pipeline gas gathering system, compression stations, and field office.

DJ Basin

Lincoln County CO

Producing wells: 15

Net acres: 16,000

Proved reserves: 0.7 MM BOE

Vertical, low-decline, oil-weighted assets and associated production facilities in Colorado’s oil-rich Denver-Julesburg (“DJ”) Basin.